The apparel industry is going through one of the most challenging times.

The impact of recession, post covid slowdown, war in Ukraine and inflation in most parts of the world has affected sales of apparel and fashion.

After the COVID-19 pandemic in 2021, with 18 months of robust growth from early 2021 through to mid-2022, the second half of 2022 saw a drop in sales across Europe and the United States, providing early indications of a slowdown in the upstream value chain.

Europe ended 2022 with around a 10 percent annual inflation; the United States, about 8 percent) and depressed customer sentiment.

As these regions contribute over 50 percent of global apparel demand, they have a significant effect on the industry—unfortunately, the end of this trend is not yet in sight and is likely to continue through 2023.

As a result, major manufacturing units across Bangladesh, India, and Sri Lanka have been forced to run at 60 to 70 percent utilization and to accept orders at near-zero margins to keep production lines running.

And, in a first-of-a-kind event, most of the manufacturing units in both Sri Lanka and Vietnam were shut or operated at minimal capacity during their 2023 New Years in April and February, respectively.

The resultant downturn in the industry has led to profit margins for apparel manufacturers in the Asian region shrinking significantly.

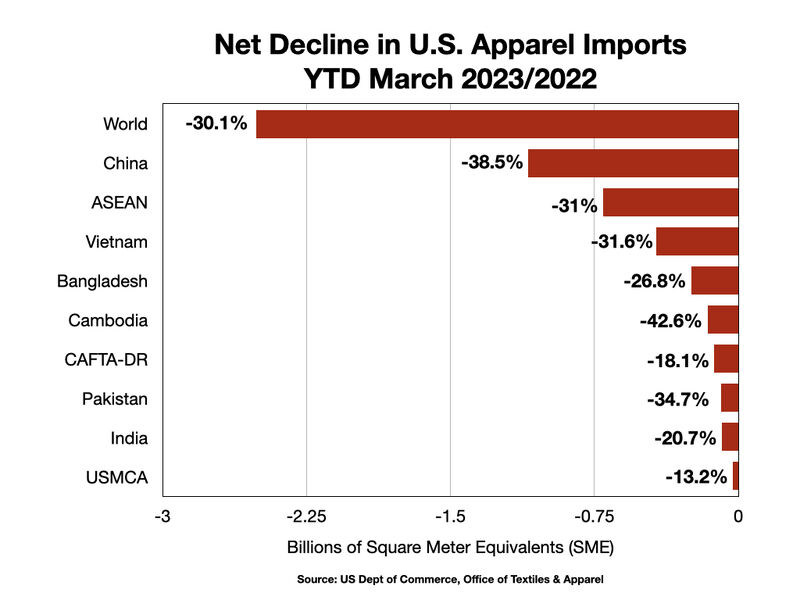

U.S. apparel imports plummeted during the first quarter of 2023. In fact, imports worldwide are down 30%, or more than 2.5 billion equivalent meters. Sourcing from China, ASEAN, South Asia, CAFTA, all has been reduced.

But why? The answer is more nuanced than claiming it’s simply an effect of inflation. Of course, inflation is a factor, but that’s nothing new; the market has been dealing with that since many years. Moreover, the U.S. dollar is weaker this year than in 2022, so imports will be more expensive when priced in dollars.

Experts claim that there has been a substantial change in consumer attitude and is one of the biggest factors that has always been responsible decrease in demand. As of now services are attracting consumers more as compared to buying new products. The sales of many clothing stores have flatlined in recent months. In turn, restaurants are busy, and airports are bustling again.

Many clothing brands and retailers are still offloading inventory from the pandemic years, contributing to weaker demand for new goods. So yeah, the supply chain suffers as a result.

Another possibility is that we may be entering a new normal. After the ups and downs of the pandemic years, with port closures and lockdowns juxtaposed with soaring consumer demand for clothing, demand may be easing back to a more sustainable level.

India’s textile and apparel exports to the US declined by 23.94 per cent to $4.70 billion during July-December 2022 compared to $6.18 billion during January-June 2022. Likewise, India’s export to EU-27 countries also declined by 24.54 per cent to $3.29 billion in the second half of 2022 compared to $4.36 billion during January-June 2022.

Exports to these regions have been consistently declining since July 2022, with only a slight increase in November and December, possibly due to the holiday season.

The downturn in India’s textile and apparel export is expected to persist in 2023, heightening the possibility of layoffs in a sector that employs over 45 million people