Acquires Stakes In Manish Malhotra And Ritu Kumar Label

Is this a beginning of new era in luxury fashion?

Buying of stakes in two very popular fashion brands by Reliance Group indicates a

new era has begun in the journey of Indian apparel retail.

The first news came in when Reliance Group bought 40% stake in the Manish Malhotra brand which is quite popular among Bollywood celebrities and high profile people of country.

The deal is intended to boost the brand’s positioning and drive international growth. It comes amid mounting investor interest in India’s luxury labels.

“A question I am often asked is: why isn’t there a true luxury brand out of India? In three years time, I would expect people to say, ‘Well, there’s Manish Malhotra, that’s a global luxury brand that comes out of India.’ That’s the mission we are driving towards,” said Darshan Mehta, RBL’s managing director and chief executive.

Manish Malhotra has a physical retail footprint of four stores in India and a social media following in excess of 12 million over various channels.

The privately held company doesn’t disclose sales results, but Malhotra said the brand already has a strong following in the US, UK and Middle East regions.

Going forward, there are plans to tap into those markets with pop-ups, e-commerce expansion and more physical stores.

Meanwhile, RBL has a wide portfolio of fashion brand partnerships in the Indian market, with international labels such as Burberry, Diesel, Versace and Tory Burch.

It has built out a substantial physical retail infrastructure that includes 1,339 doors split between 595 stores and 744 shop-in-shops in India.

The acquisition of a stake in Manish Malhotra is the retail giant’s second investment in an Indian designer brand, following its investment in Raghavendra Rathore in 2018.

It follows a run of similar investments earlier this year from domestic retail market rival Aditya Birla Fashion and Retail, which acquired a 51 percent stake in Sabyasachi Mukherjee’s Sabyasachi label in January, before acquiring a 33 percent stake in Tarun Tahiliani’s luxury demi-couture business for 670 million rupees (approximately $9.25 million) in an all-cash deal in February.

Though India’s demi-couture and occasion-wear business, largely dependent on weddings, has suffered from a lack of events during the pandemic, as India’s vaccination drive kicks into gear and restrictions are lifted, these gatherings have come roaring back.

Malhotra said this wedding season has been his brand’s busiest and most profitable in years.

India’s luxury market is one of the fastest growing in the world, estimated to grow from its current market value of $30 billion annually to more than $200 billion in 2030, according to McKinsey.

Post-investment, the brand will continue to be led by Malhotra, who will serve as both its managing and creative director.

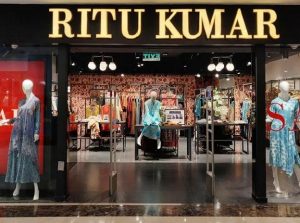

Within a week post this announcement another news of Reliance about acquisition of 52% stake in Ritika Pvt Ltd that owns- Ritu Kumar, Label Ritu Kumar, RI Ritu Kumar, aarké, & Ritu Kumar Home Living came in.

Within a week post this announcement another news of Reliance about acquisition of 52% stake in Ritika Pvt Ltd that owns- Ritu Kumar, Label Ritu Kumar, RI Ritu Kumar, aarké, & Ritu Kumar Home Living came in.

Ritu Kumar business includes four fashion brand portfolios which cumulatively retail out of 151 point of sales globally RI Ritu Kumar is a luxury bridal couture & occasion wear line. Its products heirlooms & produced by finest craftsmen and artisans.

Isha Ambani said, “Very few countries can match the sophistication, style and originality of design, especially in printing and painting of textiles and weaves, found in India. We are delighted to partner with Ritu Kumar, who has strong brand recognition, potential for scale, and innovation in fashion &retail – all key to a complete lifestyle brand. Together, we want to build a robust platform and customer ecosystem for our native textiles and crafts both in India and across – so that our crafts receive the honour and recognition they deserve in international couture”