Brands world over are foraying into digital spaces to spin money via e-businesses. And that’s quite obvious as well, seeing the major shift in the purchasing habits of shoppers globally. Consumers tend to shop more from the comfort of their homes, sitting on the couch, through their smartphones or laptops or even tablets.

Well that’s what has been gaining traction in the past years. But now, what’s grabbing eyeballs of not only the business experts but also fashion biz-focussed media houses like ours (Perfect Sourcing) to actually understand what people love more today and i.e., undoubtedly, ‘TRAVELLING’! Call it the need to escape from the loaded lives of today or the desire to explore the world, people now are travelling more than ever. As per a survey by The Times magazine, 72 percent of the respondents affirmed that they need a break from their droning routine and would like to take a trip to a new place to experience a different life.

Complementing the above research, the Oxford University highlighted that there had been an average 77 percent surge in the income since the last decade which is why people tend to travel more compared to the past. This emerging market scenario has propelled numerous fashion brands to tap on these ‘travellers cum consumers’, to bolster sales. Though beauty brands and food chains have been dominating the travel retail business for years, clothiers have now amplified their presence too in the recent past.

So what actually is Travel Retail?

Well, it is being stated that travel retail (also termed as duty-free retail) is the global industry engaged in the selling of goods to global travellers. Notably, sales at these duty-free shops are excused from the expense of certain local or national taxes and excise duties, generally with the requirement that the items are only sold to travellers who will take them out of the territory. In the travel retail business, garments, footwear, fashion accessories, and leather goods remain some of the key goods retailed at the duty-free stores.

It is pertinent to mention here that travel retail, and airport retail in particular (as mentioned above with the rising income, people tend to take the air route to travel), has been experiencing a remarkable growth in the past few years. Industry professionals expect airport sales to uphold the constructive trend, improving each year to reach US $ 100 billion in ten years.

Notably, over 1 billion people travel worldwide every year. And passenger numbers are probable to amplify even more, particularly in emerging ‘retail’ countries like China where brands are setting up stores, like fast-fashion brand Uniqlo.

Why people spend more while travelling?

Airports are an independent shopping spaces where the demarcation between luxury and casual labels becomes indistinct. Travellers just have to enter the ‘open-plan’ stores to get an easy access to fashion brands and items they may not have visited in a more traditional setting in their home country.

Also, long wait times and demands to turn up in advance give commuters several hours to spare at airports, which encourages them to unhurriedly walk around and shop. Interestingly, shops at airports also have the benefit of knowing well in advance when their customers will show up, where they are from and where they are heading to and thus, attend them accordingly.

Retailers are using this data in creative ways. Markedly, World Duty Free Group, an Italy-based multinational travel retailer, organises its human resources and product displays based on flight schedules. This way, travellers are greeted by staff speaking their language and with the needed cultural sensitivities. Display products are also altered based on the nationalities of the crowd at the airports, to ensure that the right products are clearly visible to them.

The brands have realised that travel retail provides them with opportunities to amplify visibility for their products, increase customer loyalty and engage new customers in diverse nations.

In addition, Airports have turned out to be an area where brands experiment their possible success in new markets. Many lables offer ‘travel retail exclusive’ to persuade shoppers to purchase to their desire, and ultimately pay more for the ‘exclusive’ items.

As travel retail is expected to grow further in the years to come, brands count on some of their success in airports to trickle down to their traditional stores, and possibly help open new, profitable markets. The tiny pop-up stores are now turning into classy boutiques, and giving world-class shopping experiences to strike customers, and get the sales progressing.

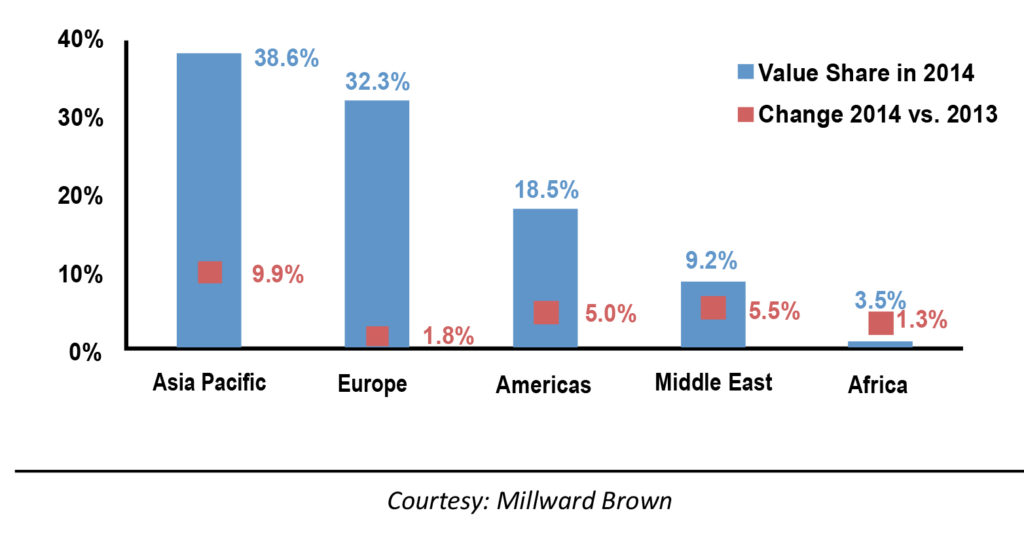

Strikingly, the luxury products that include fashion and accessories reportedly constitute 37 percent of the sales at airports globally. Hence travel retail has become a shopping window to many luxury brands. As stated by TFWA, the world’s largest duty-free and travel retail association, the Asia-Pacific is promising to be the new market and accounts to 35 percent of sales, outshining Europe and America, whose shares are 34 percent and 23 percent, respectively.

The sales of travel retail outlets are directly related to passengers, who are in awe of big brands or to whom the privilege of buying certain products is not available back home. China, Russia, and Brazil top the list of well heeled flyers splurging on luxury brands. Travelers from Middle East are the next target market in the travel retail sector and especially for the luxury fashion brands.

Unsurprisingly, the Asia-Pacific region holds the highest share of the travel retail market. The market in the region increased by 9.9 percent in 2014, year over year, marking the fastest growth rate in the world.

According to Chinese travel booking giant, Ctrip, Japan is the top destination Chinese travellers during holidays, followed by Thailand and Hong Kong. Both Chinese and Korean shoppers are a well documented source of revenue for fashion brands targeting the well heeled when they holiday abroad.

In 2014, fashion and accessories retail travel sales through airport shops amounted to about US $ 4.63 billion. This data represents the sales value of the international fashion duty-free market from 2017 to 2022. In 2017, the fashion duty-free sales reached US $ 5.1 billion. The market is estimated to grow at a CAGR of 7.7 percent to reach US $ 7.4 billion by 2022. Duty-free stores are actually the bright spot in the weak fashion retail scene globally.

How’s India performing in Travel Retail Business?

Travel retail is booming in India as well, making airports the new retail destination in the country. Brands are escalating their paw marks at key airports across the nation, by this means reaching out to the wealthy voyagers, who is looking for premium products in potential retail environments.

A report by Tax Free World Association and Travel Retail Association suggests that Indians on an average splurge US $ 440 at duty-free shops, which compares well with US $ 590 that they pay out at non-duty-free shops at travel destinations. It is being sensed that airports are a coherent destination for fashion brands, which explains why lables like FCUK and Calvin Klein are launching shops in Mumbai, New Delhi and Bengaluru airports.

The Nuances Group, in a joint association with retail chain Shoppers Stop, is already running retail and duty-free spaces in India. Pantaloons is also operating retail space at the New Delhi International Airport.

As per PWC, airport retail in India has been growing at 17-18 percent annually and the revenue generated in 2011 exceeded US $ 1 billion.

The chief fashion brands that are operational at airports in India at present include Marks & Spencer (M&S), Shoppers Stop, Mango, Superdry, Lacoste, Armani Jeans, FabIndia, Tommy Hilfiger, United Colors of Benetton, W, Zodiac, Madame, Victoria’s Secret, Hugo Boss and many other.

With just 20-25 sq. mt. of space, one can set it (the store/pop-up) up anywhere in the world. It is in fact the less precarious alternative, for the basis that if for some reason it doesn’t work out well where it is, the retailer can pull out of it and test it somewhere else. These shops work on ‘impulse’ purchases. And the industry believes that impulse shopping is the key driver of sales in travel retail. And if managed properly, the potential is huge for the retailers to capitalise on.